In a world dominated by the constant flux of news cycles, it’s natural to expect that the inherent volatility of the financial markets would extend to the realm of cryptocurrencies. Bitcoin, often associated with its roller-coaster price swings, might seem like an asset that mirrors this volatility. However, recent months have defied expectations, as the price of Bitcoin has displayed significant stability, since its remarkable recovery in January 2023.

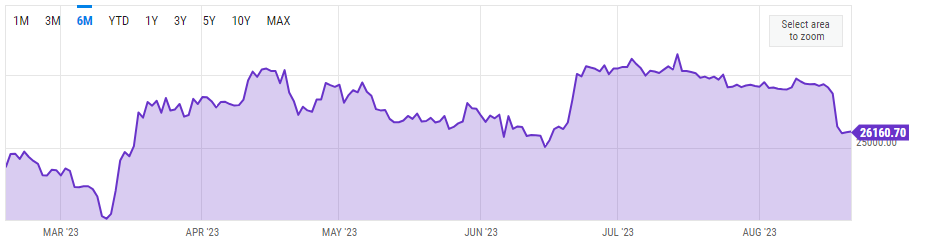

Bitcoin’s price in the last six months, between April 2023 and August 2023 | Source: YCharts

Bitcoin’s Price Stability Amidst Turmoil

This period of stability is particularly noteworthy given the circumstances surrounding the cryptocurrency landscape. Large traditional financial institutions like BlackRock have sought approval for ETFs linked to cryptocurrencies. The SEC, despite facing legal hurdles, has continued its engagement with the crypto industry, and the Federal Reserve is actively exploring the potential of a U.S. Central Bank Digital Currency (CBDC) while considering increased regulations for crypto-involved banks.

While some suggest that this stability stems from investor apathy and exhaustion, this is an oversimplification that overlooks key drivers within the crypto ecosystem. For instance, despite the calm surface, there has been a surge in both the hash rate and network growth, as indicated by research from BTC.com. This underlying activity suggests a robust foundation beneath the apparent tranquility.

Furthermore, an article from Glassnode reveals a three-year peak in the number of addresses holding 10 or more Bitcoins, including whales, who are investors who own between 1,000 and 5,000 BTC. This surge in ownership showcases investor confidence and highlights a healthy ecosystem that continues to attract new participants.

An Evolving TradFi Landscape

The traditional finance sector (TradFi) is also showing increasing interest in the crypto sector, signifying a transformative shift. The recent surge in products and services, including multiple ETF applications, is not only indicative of TradFi’s investments but is also intertwined with the reduced price volatility around Bitcoin. Lower volatility serves as both a driver and a consequence of TradFi’s growing involvement, fostering stability that aligns with the expectations of passive investors and automated trading algorithms.

Beyond Bitcoin: The Expanding Crypto Universe

It’s important to recognize that the cryptocurrency sector is not confined to Bitcoin alone. While Bitcoin remains at the forefront of media attention, it’s just one piece of a rapidly expanding ecosystem of tokenized assets. Projects on the Ethereum blockchain, for instance, are paving the way for the broader adoption of tokenized assets, with Ethereum often seen as a contender for leadership in the crypto world.

Decentralized Autonomous Organizations (DAOs), governance tokens, stablecoins, non-fungible tokens (NFTs), and more advanced tokenization initiatives are all contributing to the growth and diversification of the crypto space. Bitcoin’s price stability in this context isn’t a sign of stagnation; rather, it’s emblematic of a maturing ecosystem that accommodates a wide array of use cases and appeals to an expanding range of participants.

Rather than indicating exhaustion, Bitcoin’s period of stability reflects an ecosystem that’s flourishing, attracting significant interest from traditional finance, and embracing a diverse array of projects and innovations.