Picture a world where the last Bitcoin is mined, and crypto-enthusiasts everywhere gather to celebrate this momentous occasion. What’s next? Does the world end? Do we all just pack up and go home? Fear not: let’s dive into the future of Bitcoin mining and how the cryptocurrency ecosystem might adapt when the last coin is unearthed.

The Great Bitcoin Halvenings

Just like a thrilling movie franchise, Bitcoin has its own series of halvenings. These halvenings are not plot twists, but rather, they control the rate of Bitcoin production. Roughly every four years (or every 210,000 blocks), the block reward for miners is cut in half. From the initial 50 BTC reward, we’ve reached a current reward of 6.25 BTC per block. The halvenings will continue until the final Bitcoin is mined, which is estimated to happen around 2140.

BREAKING: The next #Bitcoin halving is now officially less than 1 year away 🚀 pic.twitter.com/tH08THjJtv

— Bitcoin Magazine (@BitcoinMagazine) April 30, 2023

The 21 Million Coin Question

As of May 3, 2023, at 1 p.m. (PST) there are 19,363,318 Bitcoins in existence, sitting at roughly 92% of all Bitcoins that will be issued. Once all 21 million coins have been mined, no new Bitcoins will be created.

While this may sound like a bummer for latecomers, there’s still hope. Transaction fees will become the main source of income for miners, incentivizing them to continue validating transactions. And who knows, maybe by 2140, we’ll be using Bitcoin to buy hoverboards or teleportation tickets.

Lost and Found

It’s important to note that not all 21 million Bitcoins will be accessible. Some estimates suggest that around 7% of all mined BTC is lost due to forgotten passwords, misplaced wallets, or untimely demises. As the saying goes, “You can’t take it with you,” especially when it comes to digital currencies.

The Market in Motion

With no new Bitcoins being mined, the supply of available coins will remain fixed. This scarcity could potentially drive the price of Bitcoin even higher. You might be thinking, “Wouldn’t that simply create hyperinflation?”

Great question. The simple answer is no. Bitcoin will become divisible into smaller units through Satoshis (or Sats for short). Unsure of what this means? We dove into this topic a few weeks ago, have a read here.

History has shown that Bitcoin’s price tends to increase in the days following a halving (based on Bitcoin’s three previous halving cycles).

#Bitcoin halving cycles. pic.twitter.com/VK5TLxWWMp

— Dylan LeClair 🟠 (@DylanLeClair_) April 27, 2023

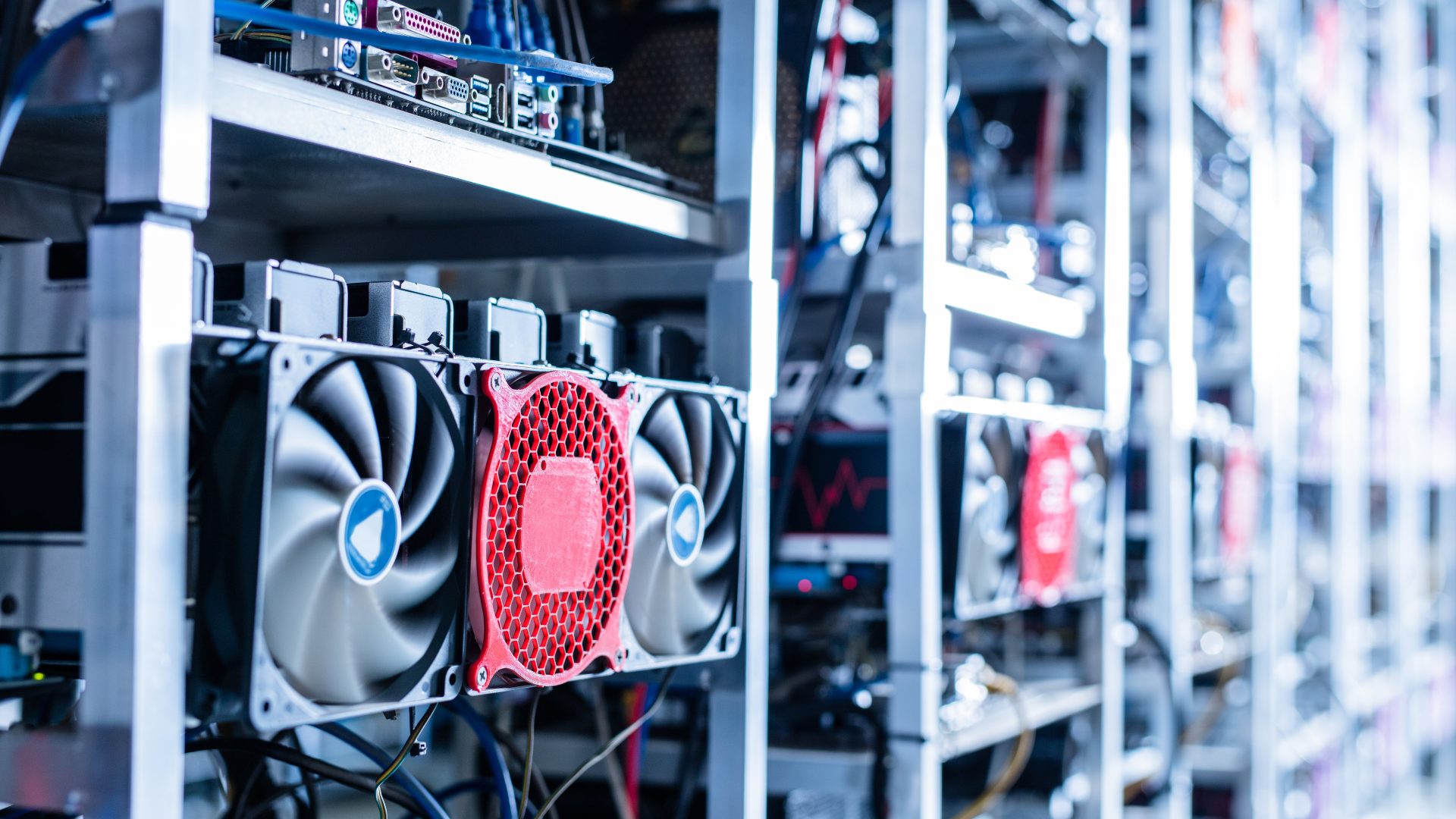

A Miner Adjustment

Miners, the backbone of the Bitcoin network, will have to adapt to the new reality of no block rewards. As mentioned earlier, transaction fees will become their main source of income. If the value of Bitcoin continues to rise, miners might charge higher fees to make processing transactions profitable enough to continue their work.

The final Bitcoin mining chapter is still over a century away. While no one can predict the exact outcome, one thing is certain – the cryptocurrency ecosystem will continue to evolve. As we approach the end of the Bitcoin mining era, we’ll undoubtedly see new innovations and adaptations in the world of digital currency. So, buckle up, and enjoy the ride.